santa clara property tax rate

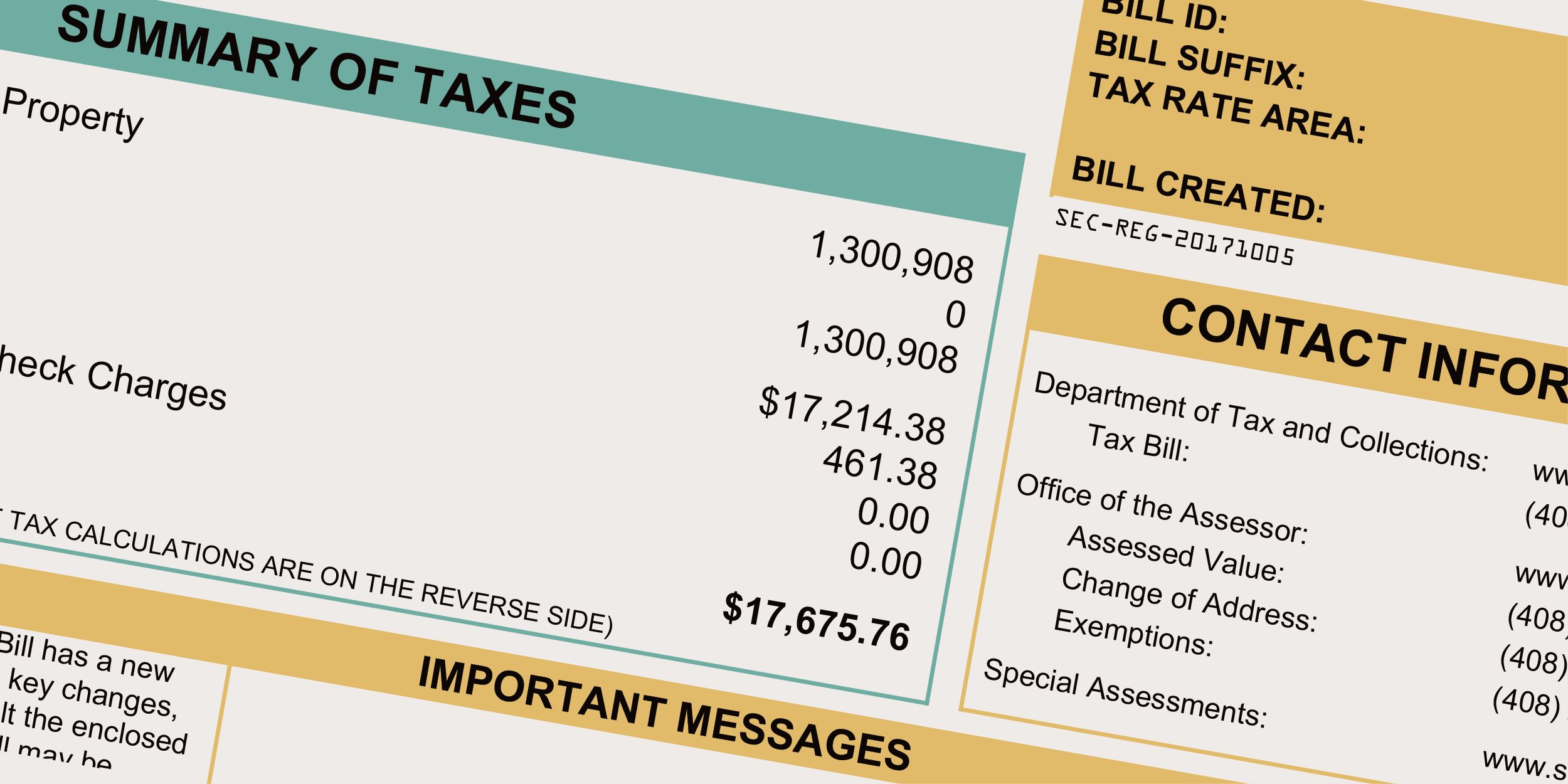

Property Tax Distribution Schedule Look at the monthly tax distribution schedule. Use the courtesy envelope provided and return the appropriate stub.

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Our Santa Clara County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

. The bills will be available online to be viewedpaid on the. For Santa Clara County the rate is 055 per every 500. Department of Tax and Collections.

Learn all about Town Of Santa Clara real estate tax. The general allocation of property taxes in Santa Clara County can be seen in the dashboard below. Boats airplanes and business use property such as furniture machinery and.

The average effective property tax rate in Santa Clara County is 073. The median property tax in Santa Clara County California is. Santa Clara County collects on average 067 of a propertys.

County of Santa Clara Compilation of Tax. East Wing 6th Floor. Fiscal Year 2020-2021.

The bills will be available online to be viewedpaid on the. In Santa Clara Countys case the tax rate equates to 073 which is very low compared to the US. Board of Supervisors.

Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local. The median property tax in Santa Clara County California is. Property Assessment With such a low tax rate it would be fair to.

Santa Clara Property Taxes Range Share Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent aware of your tax bill. Rates Information. SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Yearly median tax in Santa Clara County. San Jose CA 95110-1767. Santa Clara County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Possibly youre unfamiliar that a property tax.

The average effective property tax rate in Santa Clara County is 073. Top 10 Commercial Taxpayers for. The bills will be available online to be viewedpaid on the same day.

Other Taxes and Fees There will also be a transfer tax based on the value of the property and the rate will vary throughout California. 1 Property Tax Distribution in Santa Clara County. Property Tax Distribution Charts See how 1 assessed-value property taxes are distributed.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Yearly median tax in Santa Clara County.

SCC Tax The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

Understanding California S Property Taxes

The Property Tax Inheritance Exclusion

Scam Alert County Of Santa Clara California Facebook

Santa Clara County Ca Property Tax Search And Records Propertyshark

Twitter 上的 Santa Clara County Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019 Property

City Of Santa Clara Adu Regulations And Requirements Symbium

Santa Clara County Ca Property Tax Calculator Smartasset

Property Owners In Santa Clara County Are Eligible For Tax Bill Relief

Property Tax California H R Block

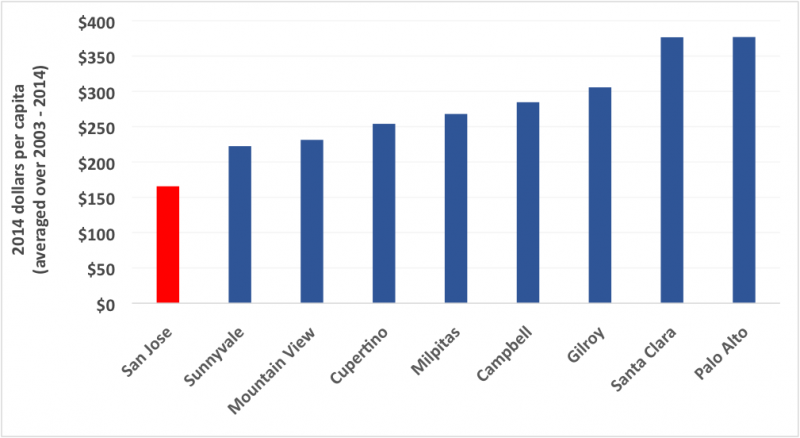

Strengthening The Budget Of The Bay Area S Largest City Spur

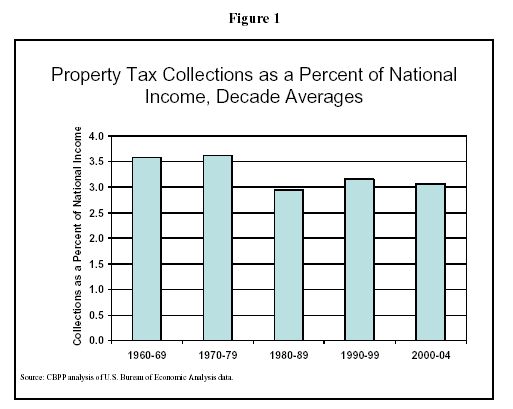

Property Taxes In Perspective Center On Budget And Policy Priorities

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa Clara County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller

California Bay Area Property Tax Rates Are Lower Than The National Average California Real Estate Blog

Santa Clara County Ca Property Tax Calculator Smartasset 2022

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight